Business Insurance in and around Norwalk

Get your Norwalk business covered, right here!

Insure your business, intentionally

Help Protect Your Business With State Farm.

As a business owner, you have to manage all areas of business, all the time. The details can be overwhelming! You can save time by working with State Farm agent Cindy Norcross. Cindy Norcross can relate to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

Get your Norwalk business covered, right here!

Insure your business, intentionally

Protect Your Future With State Farm

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have counted on State Farm for coverage from countless industries. It doesn't matter if you are an optometrist or a physician or you own a dental lab or a donut shop. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Cindy Norcross. Cindy Norcross is the person who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to understand your small business insurance options

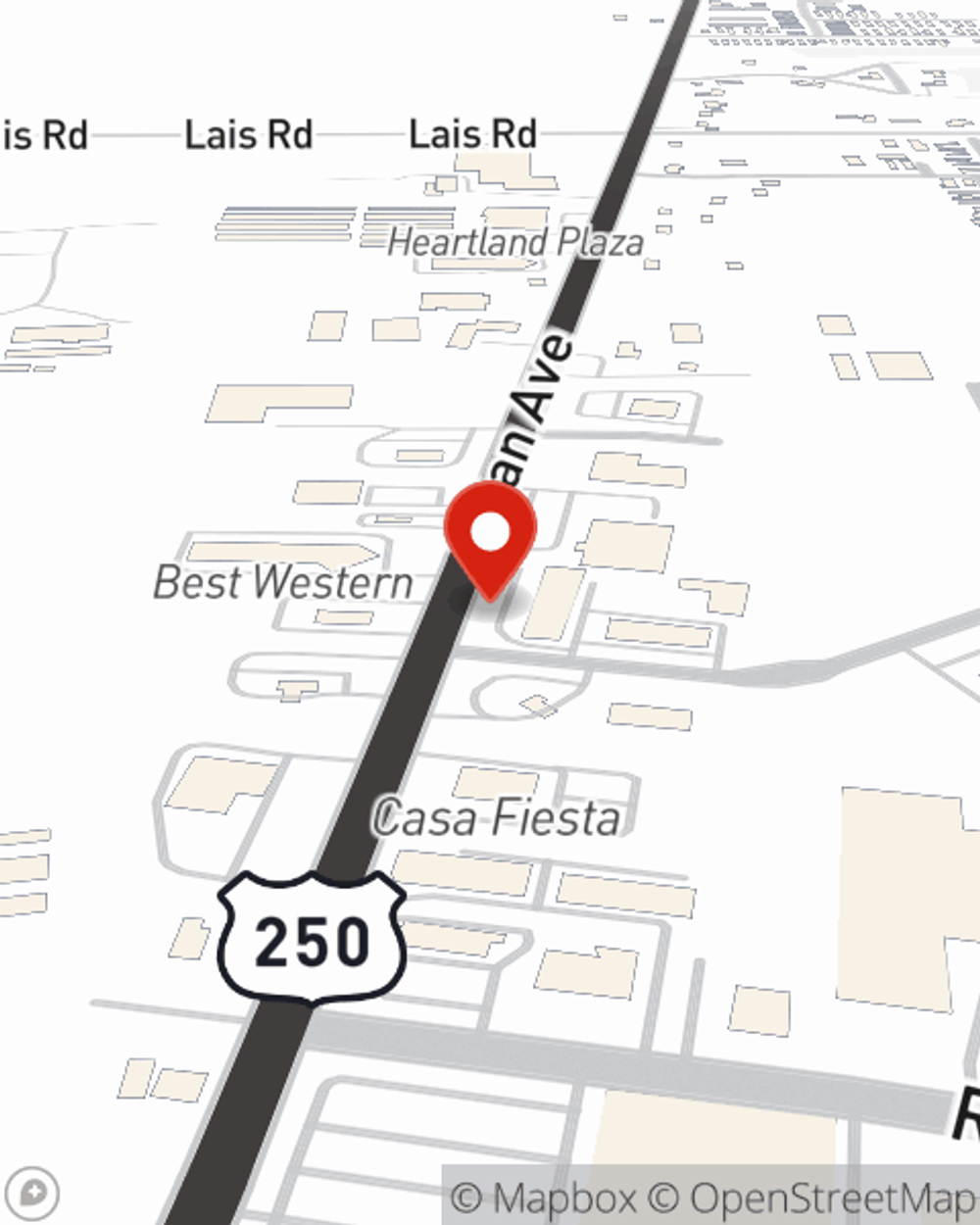

Get in touch with State Farm agent Cindy Norcross today to learn more about how the trusted name for small business insurance can safeguard your future here in Norwalk, OH.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Cindy Norcross

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.